A recent report from Bloomberg claimed that the bolstering of electric mobility in South Asian countries like India, Thailand and other could change the regional Electric Vehicle (EV) market.

The report indicated a general trend where, electric vehicles (EVs) are displacing 1.7 million barrels per day of oil usage, which is equivalent to about 3% of total road fuel demand. Currently. there are 722 million passenger EVs that are expected to be on the road in 2040 in the Economic Transition Scenario.

The Bloomberg study found that there is a 380 million gap in the number of electric passenger vehicles on the road between the economic transition scenario and the Net Zero Scenario (NZS) in 2040. This means there is a market opportunity for charging infrastructure market between today and 2050 in the Economic Transition Scenario. This can amount to 8.3 petawatt hours of electricity demand from road transport in 2050 in the Net Zero Scenario. The study analyzed and found that the sale of two-wheeler and three-wheeler electric vehicles (EVs) share is rising fast composing 47% of the market share.

The study showed that “While China continues to dominate the global EV market, the EV sales are rising quickly elsewhere too. EVs are no longer only a wealthy country phenomenon. Developing economies like Thailand, India, Turkey, Brazil, and others are all experiencing record sales as more low-cost electric models are targeted at local buyers.”

According to Bloomberg’s study EV sales rising in countries like China which have built up batteries and the EV supply chain. Chinese automakers are expanding quickly abroad as they look for new markets for their EVs. Whereas countries like Europe, the US, India, and others are following suit. These countries are now pushing back against China’s dominance with efforts to onshore manufacturing jobs and support domestic companies. It analyzes other factors such as tariffs and further protectionist measures to slow down global EV adoption in the near term.

This report suggested that at least $35 billion investment is needed in battery-cell and component plants by the end of the decade, which is easily exceeded by the $155 billion already planned by companies (Figure 7). Over-investment is most apparent in battery-cell manufacturing, where planned lithium-ion cell manufacturing capacity by the end of 2025 is over five times the 1.5TWh global battery demand expected that year. Overcapacity is a big issue for battery makers, especially as many have ambitious plans to expand.

Under BNEF’s Net Zero Scenario, new demand for lithium-ion batteries from transport is 1.7 times that of our Economic Transition Scenario and reaches 218TWh cumulatively by 2050. New technologies that lower the footprint of resource extraction will become important, and so will recycling. In lithium, for example, direct lithium extraction technologies could significantly lower the water and land use in the extraction process, while improving metal recovery.

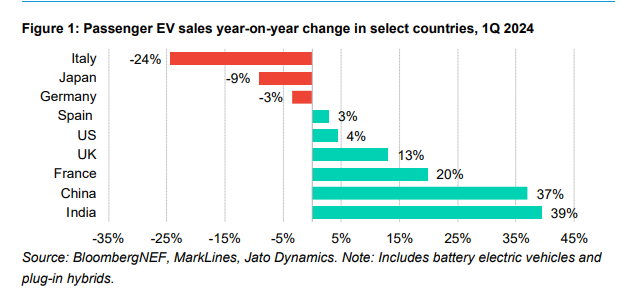

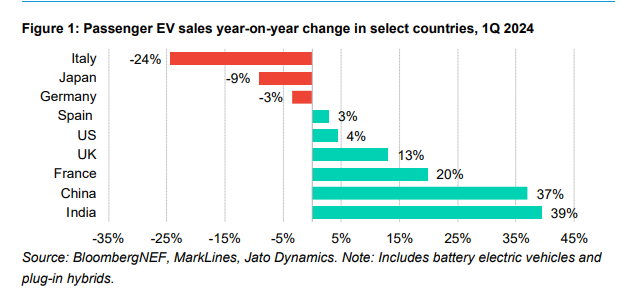

Moreover, the study showed that “The EV sales growth slowdown is real, but it is not the same everywhere in the world. Countries like China, India, and France are still showing healthy growth, but the latest data for Germany, Italy, and the US is more concerning. In Japan, the lack of EV commitment from the major domestic car makers, as well as no new models in the mini-car segment (kei-car) are holding the market back. Still, some slow-down was expected and the global growth rate in 2024 is broadly in line with BNEF forecasts from previous years.”

In the lithium-ion battery market, demand is rising quickly. Compared to last year, when the growth in battery demand for EVs slowed slightly, but demand for stationary storage applications is rising faster than ever. In manufacturing, the report showed that battery cells and the production of key battery components – such as cathodes, anodes, separators, and electrolytes – are concentrated in China.

Looking at the global passenger EV sales, the report found that it’s expected to continue to grow in the next few years. But the growth rate is visibly slower than before. EV sales are set to rise from 13.9 million in 2023 to over 30 million in 2027 in our Economic Transition Scenario.

The study forecast that, “In the next four years, electric car sales grow at an average of 21% per year, compared to the average of 61% between 2020 and 2023. The EV share of global new passenger vehicle sales jumps to 33% in 2027, from 17.8% in 2023. Only China (60%) and Europe (41%) are above that global average by then, but some European car markets move even faster, with the Nordics at 90% and Germany, the UK, and France all well above 40%.”

This year US, EV market has slowed down, and by 2027 only 29% of cars sold in the country are electric. Countries like Japan significantly lag other wealthy countries. Still, the underlying technology for EVs continues to get better and cheaper, with many new, lower-cost EV models set for launch in the next few years. Some of the fastest growth rates are in emerging economies, with EV sales set to quintuple in Brazil by 2027 and triple in India. The fleet of electric cars grows fast, rising to over 132 million by 2027, from 41 million passenger EVs on the road at the end of 2023.

Despite great progress and a steep growth trajectory, Southeast Asia, India, and Brazil are still below the global average adoption by then. The study recommends a stronger regulatory push in these markets to help bridge the gap with the more developed EV markets. Still, by 2040 the three regions represent 15% of the global EV market, up from just 2% in 2023 and 4% in 2030.